MODULE 6 – THE MANAGEMENT ACCOUNTANT’S PROFIT STATEMENT – ABSORPTION COSTING & MARGINAL COSTING

Module objectives:

After going through this module, you will be able to:

- Understand the marginal costing principles

- The absorption costing principles

- Prepare Management Accountant’s profit statement using both the Marginal and Absorption costing principles

- Perform a reconciliation of Marginal costing profit and Absorption costing profit

- State the differences between the two concepts

1. Marginal cost and marginal costing

- Marginal Costing

Marginal Costing: It is defined as ‘the accounting system in which variable costs are charged to cost units and the fixed costs of the period are written-off in full against the aggregate contribution. It special value is in decision making’.

It is also known as Direct Costing, Variable Costing or Contribution.

Marginal Costing differentiate between fixed manufacturing costs and variable manufacturing costs and charges only variable manufacturing costs to cost units.

The marginal cost of a product is normally its variable cost. It is made up of direct material cost, direct labour cost, direct expenses and variable overhead cost.

Contribution is the difference between sales revenue and total variable costs or the difference between the selling price of a product and its marginal costs.

[vooplayer type=”video” id=”NjI4OTc=” float=”right-25%” ]

$ $

Selling price: X

Less: Variable production costs X

Variable non-production costs X (X)

Contribution X X

Note: Contribution takes account of all variable costs. Marginal cost takes account of variable production costs only and inventory is valued at marginal cost.

- Uses of Marginal Costing

The two main uses of marginal costing are:

- For the calculation of cost of production and stock valuation;

- To provide information to management for planning, decision making and control in the short run.

Some profitability decisions which can be made are using marginal costing are:

- make or buy decision;

- shut-down decision;

- accept or reject decision;

- cost control decision;

- limiting factor decisions, etc.

- The principles of marginal costing

The principles of marginal costing are as follows:

(a)Period fixed costs are the same, for any volume of sales and production (provided that the level of activity is within the ‘relevant range’). Therefore, by selling an extra item of product or service the following will happen.

(i) Revenue will increase by the sales value of the item sold.

(ii) Costs will increase by the variable cost per unit.

(iii) Profit will increase by the amount of contribution earned from the extra item.

(b) Similarly, if the volume of sales falls by one item, the profit will fall by the amount of contribution earned from the item.

(c)Profit measurement should therefore be based on an analysis of total contribution. Since fixed costs relate to a period of time, and do not change with increases or decreases in sales volume, it is misleading to charge units of sale with a share of fixed costs. Absorption costing is therefore misleading, and it is more appropriate to deduct fixed costs from total contribution for the period to derive a profit figure.

(d) When a unit of product is made, the extra costs incurred in its manufacture are the variable production costs. Fixed costs are unaffected, and no extra fixed costs are incurred when output is increased. It is therefore argued that the valuation of closing inventories should be at variable production cost (direct materials, direct labour, direct expenses (if any) and variable production overhead) because these are the only costs properly attributable to the product.

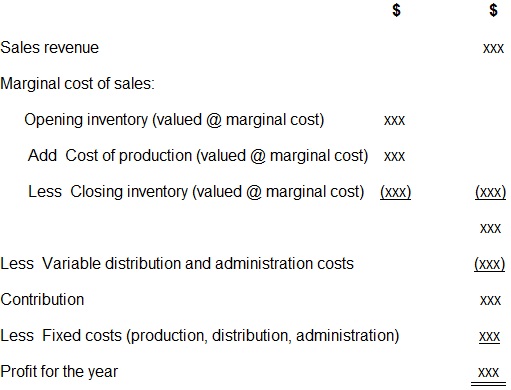

- The following is the format of a profit statement using Marginal Costing.

PROFIT STATEMENT− MARGINAL COSTING

Question

X plc. produces one product – desks.

Each desk is budgeted to require 4 kg of wood at $3 per kg, 4 hours of labour at $2 per hour, and variable production overheads of $5 per unit.

Fixed production overheads are budgeted at $20,000 per month and average production is estimated to be 10,000 units per month.

The selling price is fixed at $35 per unit.

There is also a variable selling cost of $1 per unit and fixed selling cost of $2,000 per month.

During the first two months X plc. expects the following levels of activity:

January February

Production 11,000 units 9,500 units

Sales 9,000 units 11,500 units

(a) Prepare a cost card using absorption costing

(b) Set out budget Profit Statements for the months of January and February.

Solution

(a) Cost card

$ p.u

Materials (4kg × $3) 12

Labour (4hrs × $2) 8

Var. overheads 5

Marginal cost $25p.u

Selling price $35p.u

Marginal cost (25)

Variable selling cost (1)

Standard profit $9p.u

(b)Income Statements

January February

Sales (9,000 × $35) 315,000 1 (11,500 × $35) 402,5001

Less: Cost of sales:

Opening inventory – (2,000 × $25) 50,000

Materials (11,000 × $12) 132,000 (9,500 × $12) 114,000

Labour (11,000 × $8) 88,000 (9,500 × $8) 76,000

Variable o/h (11,000 × $5) 55,000 (9,500 × $5) 47,500

275,000 287,500

Less: Closing inventory

(2,000 × $25) (50,000) –

225,000 2 287,5002

90,000 1 – 2 115,000 1 – 2

Less: Variable selling costs

(9,000 × $1) (9,000) (11,500 × $1) (11,500)

Contribution 81,000 103,500

Less: Fixed costs

Production (20,000) (20,000)

Selling (2,000) (2,000)

Actual Net Profit $59,000 $81,500

Reasons for Using Marginal Costing

The following are the arguments in favour of the use of marginal costing in product costing:

- It is simple to operate.

- Arbitrary apportionment of fixed overheads is not necessary.

Over or under-absorption of overhead is almost entirely avoided.

- Where sales are constant but production fluctuates marginal shows a constant net profit whereas absorption costing shows variable amounts of net profit.

- Accounts prepared using marginal costing more nearly approach the actual cash flow position.

- Fixed costs are related to time and do not relate to activity. Therefore it is logical to write them off in the period they are incurred and this is done using marginal costing.

- The preparation of cost and data is speeded up.

- Control over the elements of cost is readily achieved.

Arguments against Marginal Costing

They include the following:

- It is a dangerous practice to attempt fixing selling prices without considering total cost i.e., both fixed and variable cost.

- Period costs are considered in stock valuation therefore two fobs may have the same marginal cost but one may last longer than the other. The true cost of a job taking a longer time should be higher than a similar job taking a shorter time.

- In capital intensive industries or organisations the weight of fixed cost increases and must be considered in price fixing.

- In practice it is difficult to analyse costs into fixed and variable components.

- It does not apply in the long-run since all costs are variable in the long run.

2. Absorption Costing

It is defined as ‘the procedure which charges fixed as well as variable overhead to cost units’. That is a method of product costing where both fixed and variable manufacturing costs are charged to cost units. This is the method used for conventional profit reporting and stock valuation as required by IAS 2 Inventory. It is also known as Full Costing or Total Costing.

The format for a profit statement of absorption costing is shown below.

PROFIT STATEMENT− ABSORPTION COSTING

NOTE: Whether Absorption Costing or Marginal Costing is used, inventory is valued using production costs only. That is, do not use administration, selling and distribution overhead in the valuation of stocks.

Question

X plc. produces one product – desks.

Each desk is budgeted to require 4 kg of wood at $3 per kg, 4 hours of labour at $2 per hour, and variable production overheads of $5 per unit.

Fixed production overheads are budgeted at $20,000 per month and average production is estimated to be 10,000 units per month.

The selling price is fixed at $35 per unit.

There is also a variable selling cost of $1 per unit and fixed selling cost of $2,000 per month.

During the first two months X plc. expects the following levels of activity:

January February

Production 11,000 units 9,500 units

Sales 9,000 units 11,500 units

(a) Prepare a cost card using absorption costing

(b) Set out budget Profit Statements for the months of January and February.

Solution

(a) Cost cards:

$ p.u

Materials (4kg × $3) 12

Labour (4hrs × $2) 8

Var. overheads 5

Fixed overheads ($20,000/10,000) 2

$27p.u

Selling price $35p.u

Standard profit $8p.u

(b) Income Statements

January February

Sales (9,000 × $35) 315,000 (11,500 × $35) 402,500

Cost of sales:

Opening inventory – (2,000 × $27) 54,000

Materials (11,000 × $12) 132,000 (9,500 × $12) 114,000

Labour (11,000 × $8) 88,000 (9,500 × $8) 76,000

Variable o/h (11,000 × $5) 55,000 (9,500 × $5) 47,500

Fixed o/h (11,000 × $2) 22,000 (9,500 × $2) 19,000

297,000 310,500

Less: Closing inventory

(2,000 × $27) (54,000) –

243,000 310,500

Standard Gross Profit

(9,000 × $8) 72,000 (11,500 × $8) 92,000

Adjustment for over/ (under)

absorption of fixed overheads

2,000 (1,000)

Actual fixed o/h: 20,000 Actual: 20,000

Absorbed: 22,000 Absorbed: 19,000

Actual Gross Profit 74,000 91,000

Less: selling costs

Variable (9,000 × $1) (9,000) (11,500 × $1) (11,500)

Fixed (2,000) (2,000)

Actual Net Profit $63,000 $77,500

Reasons for Using Absorption Costing

The following are the arguments in favour of the use of marginal costing in product costing:

- It is easy to understand and widely used.

- Absorption costing recognises the fact that fixed cost must be incurred for production to proceed. Therefore all relevant costs, fixed and variable, must be included in the costs of production.

Where production is constant but sales fluctuate, net profit fluctuations are less with absorption costing than with marginal costing.

- Where stock building is necessary part or operations i.e., seasoning, spirit maturing, firework manufacture, etc. the inclusion of fixed costs in stock valuation is necessary and desirable. Otherwise a series of fictitious losses will be shown in earlier periods to be offset eventually by excessive profits when goods are sold.

- It is better in terms of pricing especially under conditions where fixed costs are relatively much higher than variable costs i.e., capital intensive business.

- The calculation of marginal cost and the concentration on contribution may lead to the firm setting prices which are below total cost although generating some contribution. Absorption costing makes this less likely because of the automatic inclusion of fixed costs.

IAS 2 Inventories recommends the use of absorption costing for financial accounts because costs and revenues must be matched in the period when the revenue arises and not when the costs are incurred. Also it recommends that stock valuation must include production overheads incurred in the normal course of business even if such overheads are time related. The production overhead must be that which relate to normal activity levels.

Arguments against Absorption Costing

- It can lead to wrong decision making where irrelevant costs are taken into consideration.

- There is arbitrary apportionment of fixed overhead cost.

- There are normally over or under-absorption of overheads.

Assignment

Cost and selling price details for product Z are as follows.

$ per unit

Direct materials 6.00

Direct labour 7.50

Variable overhead 2.50

Fixed overhead absorption rate 5.00

| $ Per unit | |

| Direct materials | 6.00 |

| Direct Labour | 7.50 |

| Variable Overhead | 2.50 |

| Fixed overhead absorption rate | 5.00 |

| 21.00 | |

| Profit | 9.00 |

| Selling price | 30.00 |

Budgeted production for the month was 5,000 units although the company managed to produce 5,800 units, selling 5,200 of them and incurring fixed overhead costs of $27,400.

Required: Determine the following for the month the;

- marginal costing profit;

- Absorption costing profit.

3. Reconciling profits

Reported profit figures using marginal costing or absorption costing will differ if there is any change in the level of inventories in the period. If production is equal to sales, there will be no difference in calculated profits using the costing methods.

The difference in profits reported under the two costing systems is due to the different inventory valuation methods used.

If inventory levels increase between the beginning and end of a period, absorption costing will report the higher profit. This is because some of the fixed production overhead incurred during the period will be carried forward in closing inventory (which reduces cost of sales) to be set against sales revenue in the following period instead of being written off in full against profit in the period concerned.

If inventory levels decrease, absorption costing will report the lower profit because as well as the fixed overhead incurred, fixed production overhead which had been carried forward in opening inventory is released and is also included in cost of sales.

Reconciling profits – a shortcut

A quick way to establish the difference in profits without going through the whole process of drawing up the income statements is as follows.

Difference in profits = change in inventory level x overhead absorption rate per unit

If inventory levels have gone up (that is, closing inventory > opening inventory) then absorption costing profit will be greater than marginal costing profit.

If inventory levels have gone down (that is, closing inventory < opening inventory) then absorption costing profit will be less than marginal costing profit.

Question:

Prepare a reconciliation of absorption and marginal costing profits

January February

$ $

Absorption costing

Marginal costing

Difference

Solution

January February

Absorption costing 63,000 77,500

Marginal costing 59,000 81,500

Difference 4,000 (4,000)

Fixed overheads in inventory value:

Opening inventory (2,000 × $2) – (4,000)

Closing inventory (2,000 × $2) 4,000 –

4,000 (4,000)

Enroll in the course here

You tube Channel here