Module objectives:

After going through this module, you will be able to:

1.Explain the various ways of stock controls

2.List documents used by organisations for inventory control

3.Understand the various stock levels and their concepts

4.Calculate the cost of inventory

5.Prepare the Material Control Account

1.1.Introduction

Materials refer to the basic inputs, ingredients or components that undergo significant changes in a production process.

Materials represent one of the inventory items that a manufacturing business may keep. Other types of inventory may be:

1.Work-in-progress or partly finished stocks

2.Components or spare parts

3.Sub-assemblies

4.Consumable stores

5.Finished goods

6.Loose tools such as pick axes, shovels, pliers, hammers, etc.

The amount some businesses invest in inventory or materials may be so huge that an effective stock control system becomes inevitable.

1.2.Stock Control

This refers to the processes involved in ordering, purchasing, receiving stocks into stores, storing and issuing stocks and maintaining appropriate levels of stocks.

The following are the major steps in stock control:

1.Ordering and purchasing

2.Reception and inspection

3.Coding

4.Storage

5.Issuing

6.Stock taking

7.Setting stock levels.

[vooplayer type=”video” id=”NjI4OTQ=” float=”right-25%” ]

1.3.Some Documents Used for Purchasing and Issuing Materials

1.Purchase Requisition Note or Form: It is a document issued by the stores department or a user department to the purchasing department authorising the department to order new stocks.

2.Quotation or Tender Document: This is a document issued to prospective suppliers to obtain their terms of supply, such as; price, delivery, quantity and quality. Reliability of supply is also an important factor that needs to be considered when selecting a supplier.

3.Purchase Order: It is a document prepared by the purchasing department and sent to a supplier for goods to be supplied.

4.Delivery Note: It is a document which accompanies goods received from a supplier. This document is signed by the store keeper to confirm that goods have been delivered.

5.Goods received note: It is a document prepared to acknowledge the acceptability of goods delivered by a supplier.

6.Materials or stores requisition note: It is a document issued by a production or user department to request for materials from the stores department.

7.Materials Return Note: It is used with materials being returned to store. The details on this document are similar to materials Requisition Note (since material return is the reverse of material requisition).

8.Materials Transfer Note: It is issued with materials transferred from on job or cost centre to another, without first being returned to store. Note that stock control documents are issued in duplicates or triplicates and copies sent to all relevant departments.

1.4.Storage, Recording and Stocktaking

Materials are normally stored in bins or racks. Proper storage is necessary for the following reasons:

- Prompt receipt and issue

- Protection of materials from damage, theft, deterioration, etc.

- Correct location and identification of materials

- Efficient use of storage space

- Maintenance of correct stock levels

- Putting stocks under the care of a responsible official and so on.

The following are the two main documents used for recording the receipt, issue and balance of stocks held:

- Bin Card: It is used to record the movements of stocks in a particular bin or location. It records receipts and issues of materials by the storekeeper as well as stock balances.

- Stores Ledger Account: It is a subsidiary Ledger maintained by the stores department to record the movement of stocks both in quantity and value.

Note that stock balance may refer to physical stock balance or free stock balance. Free stock balance can be calculated as:

Materials in stock (Physical Stock balance)xxxx

Materials on order from suppliers xxxx

Materials requisitioned but not issued(xxxx)

Free stock balancexxxx

Codification of Stocks

This refers to the use of numbers, letters and/ or symbols for the identification of materials. Some of the benefits gained for using codes are:

- Time saving

- Prevention of ambiguity

- Accurate identification of materials leading to production efficiency

- Makes computerisation easier

- More flexible

1.5.Stocktaking

This refers to the physical verification of stocks in a store and checking the result against the book stocks. This may be done on a continuous (more frequent) or periodic basis.

a.Continuous Stocktaking is the counting and valuing of physical stocks more frequently. This involves a specialist team counting and checking a number of stock items on daily basis, so that each item is checked at least once a year. Valuable items with high turnover could be checked more frequently.

This system has the following advantages:

i.It avoids the long disruption associated with the annual stock count.

ii.Stock discrepancies are revealed promptly.

iii.Hold-ups in production are eliminated because stores staff will not be so busy as to be unable to deal with material issues.

iv.Improvement in control over stock levels is enhanced.

v.Serves as a moral check on stores staff.

vi.More time is available for stock count and this reduces errors in stock count.

vii.Regular skilled stock takers can be employed to reduce likely errors.

Disadvantages

i.Not suitable where less stocks are carried.

ii.May interfere with the core activities of the business.

iii.Employment of regular stock takers may lead to additional cost.

b.Periodic Stocktaking

This is the counting and valuing of physical stocks at the end of an accounting period, usually annually. This system is suitable where low levels of stocks are carried.

Discrepancies after Stocktaking

The physical stocks counted in a store may be different from the book stocks in the stock records. This discrepancy must be investigated so as to prevent further occurrence. The following may be the causes of stock discrepancies:

1.Poor record keeping such as omissions or over/under statement of receipts and issues of stocks.

2.Theft or pilferage

3.Damages, deterioration or evaporation

4.Errors in stock count.

Perpetual and Periodic Inventory Systems

Stock recording may be done regularly or at the end of an accounting period. The recording of stocks such that the stock records are updated after each receipt and issue is called Perpetual Inventory System. Where the sock records are updated with total receipts and issues for a particular accounting period, the system is called Periodic Inventory System.

1.6.Stock Cost

Appropriate levels of stocks must be maintained so as to avoid minimise stock costs. Stock costs are made up of:

1.Cost of purchase

2.Cost of ordering

3.Cost of holding or storage

4.Stock out cost

The objective of stock control is to minimise the above stock costs.

1.Cost of purchase refers to the amount paid to suppliers for goods bought. This constitutes the largest of all stock costs.

2.Ordering cost is the cost associated with the processes involved in placing an order and receiving goods into store. Examples include;

(i)Clerical and administrative cost associated with purchasing, receiving and recording stocks.

(ii)Transportation costs

(iii)Set-up cost (for stocks manufactured internally, etc.

3.Holding cost refers to the costs associated with keeping stocks in the store. These include.

(i)Insurance cost.

(ii)Deterioration.

(iii)Obsolescence.

(iv)Interest on capital tied up in stocks.

(v)Cost of storage and handling of stocks such as rent, storage equipment, cost of extra staff salary for operation of the store, etc.

The following may be some of the reasons for holding stocks:

- To avoid interruptions in the production process due to shortages.

- To take care of seasonal fluctuations or variations in demand usage.

- To meet future shortages in supply.

- To ensure that expected demand can be met.

- To take advantage of bulk discounts.

- A means of investment.

- To minimise the effect of inflation.

- As a necessary part of the production process i.e. in the case of maturing cheese, wine, etc.

- To provide buffer between process.

Stock out Costs

Stock out refers to the running out of stocks by a business. The cost of stock out may include:

(i)Loss of customer goodwill.

(ii)Cost of production stoppages.

(iii)Demotivation of production personnel due to stoppages in production.

(iv)Loss of contribution from lost sales

(v)Additional cost of urgent orders

1.7.Stock Levels

The following are the three main levels of stocks that are set:

1.Maximum stock level: This is the level beyond which stocks should not exceed. If stocks exceed this level, too much capital will be tied up in stocks. The level is calculated as,

Maximum stock level = Re-order level + Re-order quantity − (Minimum Usage × Minimum lead time)

Factors influencing this level are:

- Rate of consumption.

- Lead time.

- Reliability of suppliers.

- General economic and political conditions.

- Storage capacity or facility.

- Rate of deterioration.

- Availability of funds.

2.Re-order level: The level at which a new purchase order must be issued for the replenishment of stocks.

Re-order Level = Maximum usage × Maximum lead time.

3.Minimum Stock Level: It is the least quantity of stocks below which stocks should not fall if stock out is to be prevented. It is calculated as;

Minimum stock level = Re-order level − (Average usage × Average lead time)

Minimum stock level is also called Buffer stock or Safety stock.

Other Terminologies:

Lead time is the period between when an order is made and the receipt of stocks. It is also called re-order period, delivery period, etc.

Usage: This is also known as consumption and refers to the quantity of stocks consumed during a specified period.

Average usage is also called normal usage. It can be calculated as;

Average usage = Minimum usage + Maximum usage

2

Average leadtime is also normal lead time and is calculated as;

Average lead time = Minimum lead time + Maximum lead time

2

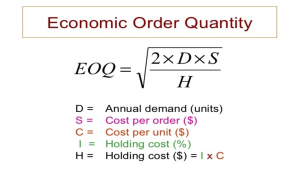

Re-order quantity refers to the quantity of stocks ordered when stocks get to the re-order stock level. Re-order quantity can be calculated from the maximum stock level formula. Where this quantity is carefully chosen so as to minimise total stock cost, the quantity is called Economic Order Quantity (EOQ).

The EOQ can be ascertained using any of the following:

- Formula approach,

- Tabular approach,

- Graphical approach.

The formula is given below:

Average stock level may be calculated from one of the following formulae. Each formula gives a different answer.

i.Average stock level = Maximum stock level + Minimum Stock level

2

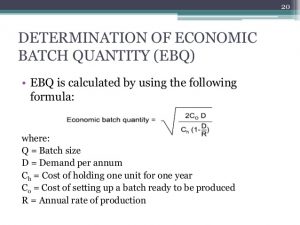

Economic Batch Quantity (EBQ)

This is similar to the EOQ model but is normally used where a business manufactures for its own consumption. The EBQ model uses a similar formula to that of the EOQ model with a minor modification as follows:

1.8.Accounting for material costs

We will use an example to illustrate how to account for the purchase and issue of raw materials.

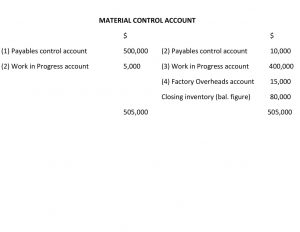

Example – material control account

Bossy Co manufactures a single product and has the following transactions for material during a particular period:

(1) Raw materials of $500,000 were purchased on credit from a supplier (Timid Co).

(2) Raw materials costing $10,000 were returned to the same supplier due to defects.

(3) The total stores requisitions for direct material for the period were $400,000.

(4) Total issues for indirect materials during the period were $15,000.

(5) $5,000 of unused material was returned to stores from production.

Required

Prepare the material control account for the period, showing clearly how each transaction is treated.

Solution

Notes on transactions:

(1) All raw material purchases are entered into the material control account as a debit entry – the corresponding credit goes to the payables control account.

(2) Any returns of material are treated in the opposite way to purchases of material.

(3) Direct material is directly related to production. The material control account will be reduced (credited) by the amount of material being issued. On-going production is represented by a Work in Progress account in the ledger system.

(4) Indirect materials are not directly related to production so will not affect the Work in Progress account. Such materials are classed as factory overheads and will therefore be entered into a Factory Overheads account.

(5) The unused material returned to stores (inventory) will increase materials inventory and will therefore be a debit entry in the material control account. As it is being returned from production, the corresponding credit entry will be in the Work in Progress account.

Enroll in the course here

You tube Channel here